Uncovering investment opportunities through Analysis of Unstructured Data:

Private equity professionals play a crucial role in the world of investments. They possess a unique set of skills and expertise that enable them to investigate, analyze, and uncover potential investment opportunities. Such investigative work necessarily involves checking the discovered facts for correctness. In this blog, we will explore how private equity professionals leverage unstructured data and large bodies of text in their work to check and confirm facts leading to uncovering new investment opportunities.

Key Unstructured Data Sources for Private Equity Professionals:

-

- News articles and press releases: These provide real-time information on market developments, company announcements, and industry trends.

- Social media platforms: Private equity professionals monitor platforms like Twitter, LinkedIn, and industry-specific forums to gather insights, sentiment analysis, and gauge public perception.

- Industry reports and research papers: These publications offer in-depth analysis and market intelligence, helping professionals stay informed about industry-specific trends, opportunities, and risks.

- Regulatory filings and public disclosures: These documents, such as annual reports, filings with securities regulators, and prospectuses, provide essential financial and operational information.

- Company websites and investor presentations: Private equity professionals analyze company websites and investor presentations to gain insights into the company’s vision, strategy, and financial performance.

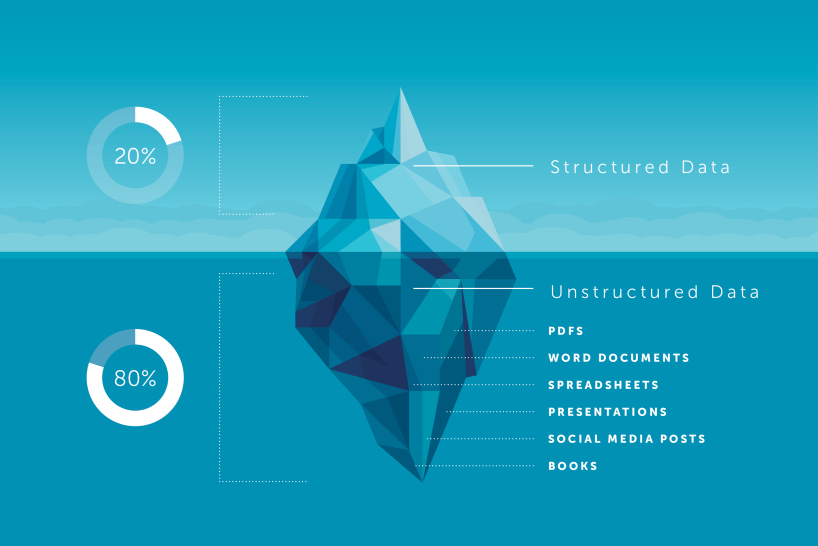

Unstructured data, mainly text, poses challenges in automating its processing. Automation is an obvious requirement to handle the volumes of text prevalent today in the enterprise.

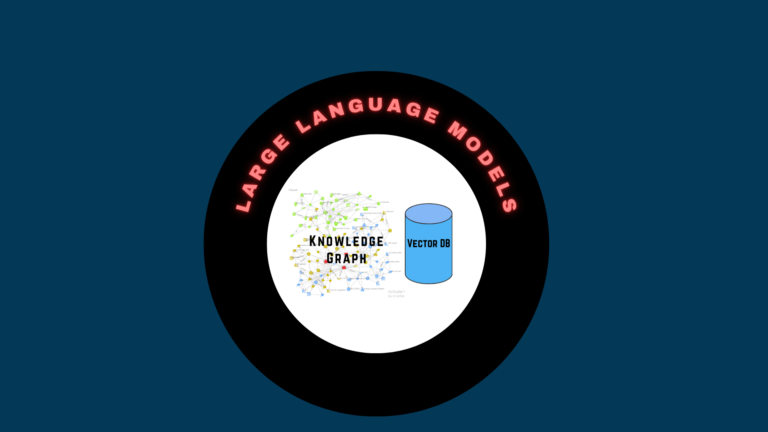

Knowledge-based techniques and modern Natural Language Processing technologies based on GenAI can comprehend language (text). Together these technologies make automation of understanding large volumes of text (unstructured data) practical.

Modern NLP Using GenAI and Semantic Technology

TextDistil is one such modern Knowledge and Language processing automation solution that is built using GenAI and Semantic Technology. Using TextDistil, private equity professionals gain the ability to analyze and confirm facts through easy visual verification. It enables private equity experts to thoroughly analyze potential investments, including researching management, evaluating public competition data, and assessing financial statements. By delving into these details with TextDistil, they gain prompt insights into the company’s performance, competitive landscape, and growth potential, which can point to new investment opportunities.

Private equity professionals rely on various sources of information to uncover Opportunities, such as revenue growth reports, headcount trends, changes in technology usage, and more. Daily generation of an enormous amount of unstructured data and extensive texts occurs in today’s digital world. Private equity professionals understand the immense value hidden within these data sources. Using TextDistil , analysts are able to assess risks, analyze trends, and uncover growth potential or undervalued assets for clients, aiding in informed business decisions.

By harnessing the power of advanced knowledge-based analytics and modern natural language processing techniques, they can extract meaningful insights and valuable public sentiments from unstructured data such as news articles, social media posts, industry reports, and customer reviews.

This allows them to gain a holistic understanding of the market, identify emerging trends, and make informed investment decisions.

Conclusion: Private equity professionals possess unique skill sets that enable them to investigate, analyze, and uncover investment opportunities. Their ability to investigate and confirm facts, and their talent for discovering new opportunities, make them invaluable in the investment landscape.

Furthermore, by leveraging unstructured data and large texts and deploying GenAI and Knowledge solutions like TextDistil, these professionals can extract meaningful insights and make informed investment decisions. As the competitive world becomes increasingly data-driven, the role of private equity professionals in analyzing and interpreting this vast amount of information will become more crucial in identifying lucrative investment opportunities.