ESG: Driving Financial Growth and Shaping Stakeholder Expectations

The importance of ESG (environmental, social, governance) as reflected in the five fold increase of internet searches since 2019, indicating its growing significance. Companies across different industries have consistently been improving their ESG practices by allocating more resources. Previous blogs have discussed the effect of ESG on investing. In this context, it is worthwhile to note also that the ESG market will double this year. ESG is also likely to significantly impact not just investors but also consumers and stakeholders. It is now an accepted industry knowledge that the companies that follow ESG best practices have higher financial growth and better performance. In comparison, companies that performed poorly on ESG experienced a higher cost of capital and higher volatility.

Companies usually communicate their practices and initiatives to regulators and the public at large (e.g., positive contributions back to society, lowered carbon emissions, etc). Third-party organizations consolidate these communications from across industries, which are predominantly in the form of textual reports to create ESG metrics. Consequently, organizations and particularly financial services organizations face increased pressure to disclose information about ESG strategies and their practices.

TextDistil: Enabling Informed ESG Decision Making

TextDistil, a tool used by analysts and financial experts, enables the quick and accurate analysis of mountains of text and other unstructured data. TextDistil empowers users to gain valuable insights efficiently by uncovering hidden patterns, sentiments, and key ESG-related indicators within unstructured data, The extracted ESG signals, such as employee satisfaction and

well-being, corporate governance and transparency, human rights policies, cybersecurity, and data privacy measures, serve as valuable inputs to decision-making processes and downstream analytics and Business Intelligence applications. These inputs empower organizations to make informed decisions aligned with their sustainability goals.

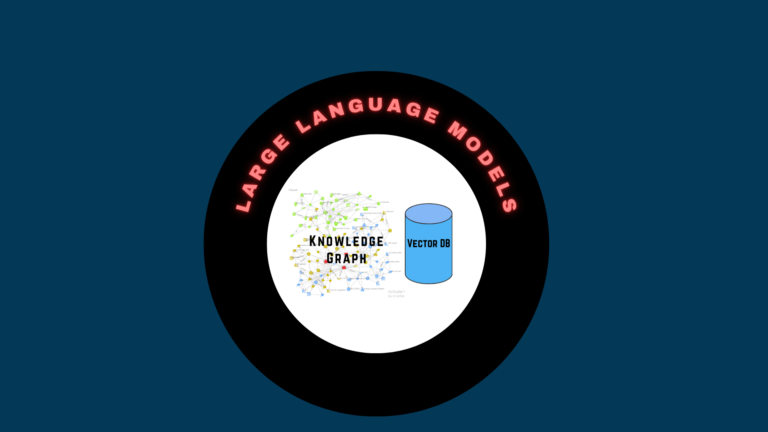

With TextDistil, businesses and investors gain understanding of the ESG landscape surrounding companies, sectors, or regions comprehensively. This understanding enables better risk assessment and strategic planning. The types of documents that can be analyzed are not limited to reports, regulatory submissions, investor calls, social media, etc. Analysts can upload news articles, SEC submissions, and social media posts and use them to extract facts and populate a knowledge graph, which in turn powers a more tractable search. Furthermore, this process delivers new knowledge to supplement the existing enterprise knowledge thus enriching the decision support environment.

TextDistil AI model represents a significant breakthrough in ESG data analysis. It significantly enhances the extraction of ESG insights from extensive textual sources. Leveraging AI, NLP, Semantics, and data analytics allows businesses, investors, and stakeholders to navigate the dynamic ESG landscape efficiently, make informed decisions, and contribute to a more sustainable future.

TextDistil unlocks ESG-related information from large bodies of text and is easy to be used by analysts and financial experts. Lead Semantics presented a talk on this very topic at the recent knowledge graph conference in New York City in May 2023.