NLP a Powerful Tool for ESG INVESTING

Environmental, Social, and Governance (ESG) factors are now widely recognized as important drivers of long-term financial performance, and investors are increasingly seeking to integrate ESG considerations into their decision-making process.

To that end, Natural Language Processing (NLP) has emerged as a powerful tool for analyzing ESG data and providing valuable insights to investors. NLP is a subfield of artificial intelligence that deals with the interactions between computers and human languages, and it can be applied to various text data related to ESG, such as news articles, social media posts, financial reports, and other sources.

Here are some ways in which NLP can be used to analyze ESG data and inform sustainable investing decisions:

-

Sentiment Analysis:

NLP can be used to analyze the sentiment of ESG-related news articles and social media posts to understand public opinion on ESG issues. By tracking sentiment over time, investors can identify potential risks and opportunities associated with certain ESG factors, and adjust their investment strategies accordingly.

-

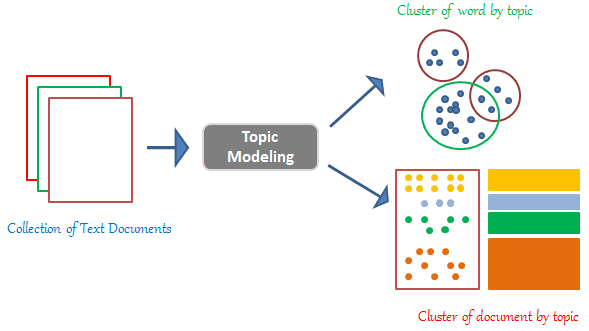

Topic Modeling:

NLP can be used to identify and categorize ESG-related topics in large volumes of text data. This can help investors understand which ESG issues are most relevant and how they are interconnected. For instance, topic modeling can reveal that climate change and renewable energy are closely linked, and that they have significant implications for companies operating in the energy sector.

-

Entity Recognition:

NLP can be used to identify and categorize specific entities mentioned in ESG-related text data, such as companies, people, or locations. By tracking the ESG performance of specific entities over time, investors can assess their ESG risks and opportunities, and make informed investment decisions.

-

Event Detection:

NLP can be used to identify significant events related to ESG, such as environmental disasters, corporate scandals, or regulatory changes. By monitoring ESG events in real-time, investors can adjust their investment strategies to mitigate potential risks and seize opportunities.

-

Text Classification:

NLP can be used to classify ESG-related text data into categories such as environmental impact, social responsibility, or corporate governance. This can help investors understand which ESG factors are most important to them and make investment decisions accordingly.

Overall, NLP is a powerful tool that can help investors make more informed decisions about sustainable investing by analyzing large volumes of ESG-related text data and providing valuable insights into ESG sentiment, topics, entities, events, and classifications. As ESG investing continues to grow in importance, NLP is likely to play an increasingly important role in shaping the future of sustainable investing.