AI Powered ESG Compliance

Background: Wider recognition that climate risks affect business and financial performance of companies has resulted in the growing importance of climate disclosures for investors. In the US the Securities and Exchange Commission (SEC) has published rules and guidance about disclosing impacts of climate change on companies’ performance. Disclosures facilitate investors’ assessment of companies’ performance by ensuring consistent, comparable and reliable information about financial effects of climate risks on a company’s business and how the company manages such risk. Accordingly, companies, Mutual Funds (MF) and Exchange traded Funds (ETFs) are required to file disclosures on climate-related information to SEC.

Streamlining Compliance Monitoring: Automation in Green Investment ETFs

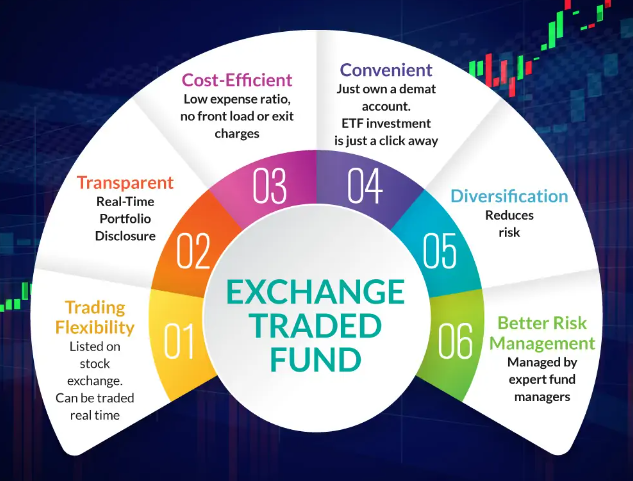

ETFs are a major player in the so-called Green investments where the investments by ETFs target companies that only meet the climate policies and guidelines set by the ETFs. These policies and guidelines are discussed in the ETF prospectuses meant for the investors.

The climate disclosures are at the heart of two critical business scenarios for the ETFs:

- Due-diligence in selecting a stock/ security for investment

- Monitoring compliance

These scenarios involve analyzing large volumes of documents that include SEC filings, fund prospectuses, business financial news, social media, etc. Yet, to date, automation support has been lacking especially considering the need for analysts to understand the text in the various documents.

Next-Generation NLP Techniques: GraphRAG in Document Analysis

Over the course of last year, a promising solution that uses LLMs and dense Vector databases for storing and retrieving the answers to natural language questions had experienced an upsurge in its adoption for use cases described in this blog. More recently, though, a newer, sophisticated technique touted GraphRAG – Graph based Retrieval augmented generation method has shown higher accuracy results and surpassed RAG in the overall effectiveness to the use cases involving large corpus of documents such as discussed in this blog. GraphRAG is an upgrade to RAG.

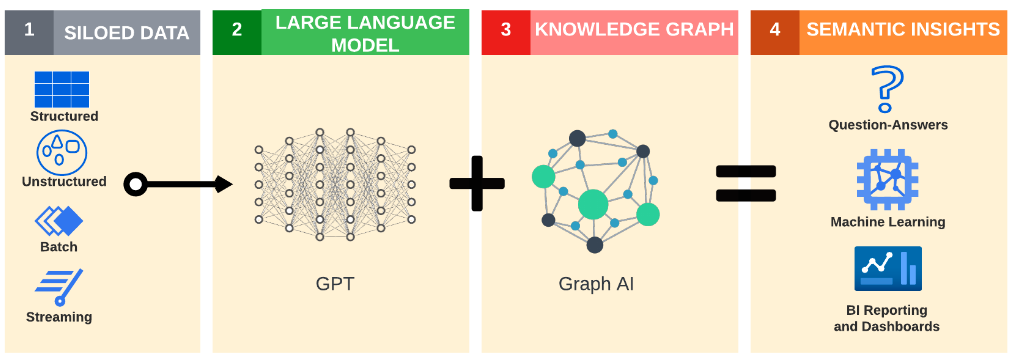

The New AI – Generative AI and Knowledge Graphs to the rescue:

The new AI which is a hybrid over Generative AI (Large Language Models or LLM) together with Knowledge Graphs (ex: GraphRAG) has proven to be practical and valuable in complex business workflows while producing results that are accurate and explainable. TextDistil from Lead Semantics, a language understanding solution built with the new AI stack, targets the two business scenarios listed above; 1) ESG compliant stock selection and 2) Due-diligence of ESG disclosure compliance.

TextDistil processes unstructured data in the form of news articles, SEC filings, blogs, industry reviews, and ETF prospectuses and populates the extracted details into the domain specific knowledge graph. It features an easy to use natural language search and allows for instant verifiability of answers. TextDistil significantly improves the speed and accuracy of analysis.

Send us an email or contact us to checkout TextDistil for automating your ESG Compliance monitoring and ESG Due-diligence.